Do you secretly (or loudly) dread this time of the year? Filing taxes is never fun, but it has to be done by all professionals, even if your income should only be whispered. As the April 15th tax filing deadline looms close, we want to make sure you do your due diligence to get your taxes in on time and that you’re aware of some of the art-related expenses you may be able to deduct. Eric Rhoads, the publisher of Fine Art Connoisseur and PleinAir, wrote a great blog post for artists as it relates to filing taxes, and we feel they need to be shared with you.

Some potential deductions to consider include:

• Magazine Subscriptions for Professional Enhancement

• Professional Development

• Advertising and Marketing

• Training Materials: Videos and Books

• Entry into Art Competitions

• Your Studio and Materials

• Dues, Memberships, and Legal

So dig out those receipts and browse your emails to find receipts all those art-related expenses you racked up last year. Did you apply for The Clark Hulings Foundation grant in September 2014? That may even qualify! However before you start claiming every art-related expense you made last year, remember you must check with an expert tax attorney or accountant, because in order to make certain deductions, there are particular qualifications you must meet and specific guidelines you must follow.

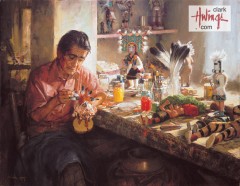

About The Clark Hulings Foundation

The Clark Hulings Foundation helps professional visual artists seize opportunities to drive their careers forward. By providing targeted support at pivotal moments, The Foundation strives to improve their prospects, and enable many more people to encounter and be enriched by their work.